Tokens could be valuable indicators for US elections

That's right, there are tokens designed to carry out hedging operations or even speculate on the United States elections through DeFi cryptocurrencies.

These are Swap instruments that are on Decentralized Finance platforms like Uniswap, for example. Typically, these candidate tokens (Harris and Trump) operate on the Ethereum network through Wrapped Ethereum. It is an ERC-20 standard token that represents Ethereum (ETH) in a “wrapped” form, making it fully compatible with the ERC-20 standard of the Ethereum blockchain. Complex? I'll explain.

The ERC-20 network is a technical standard that creates and issues smart contracts on the Ethereum blockchain. It defines a list of rules that a token must follow to be considered an ERC-20 token. This standardization is fundamental to the interoperability of tokens within the Ethereum ecosystem, allowing different applications and contracts to interact in a consistent manner.

What is Wrapped Ethereum?

As mentioned above, WETH is an ERC-20 token that represents Ethereum (ETH) in a form compatible with the ERC-20 standard of the Ethereum blockchain. This token is essential in DeFi protocols like Uniswap, Aave or Compound, where most assets are based on the ERC-20 standard. Using WETH allows Ethereum to easily interact with these protocols and participate in liquidity pools or trading pairs.

WETH arises when users “wrap” their ETH by sending it to a smart contract that returns an equivalent amount of WETH. This process is reversible, allowing WETH to be “unwrapped” back into ETH at any time.

Now that we understand the mechanism behind it, it becomes more tangible to understand how the Harris and Trump tokens traded by WETH work.

Understanding Election Tokens

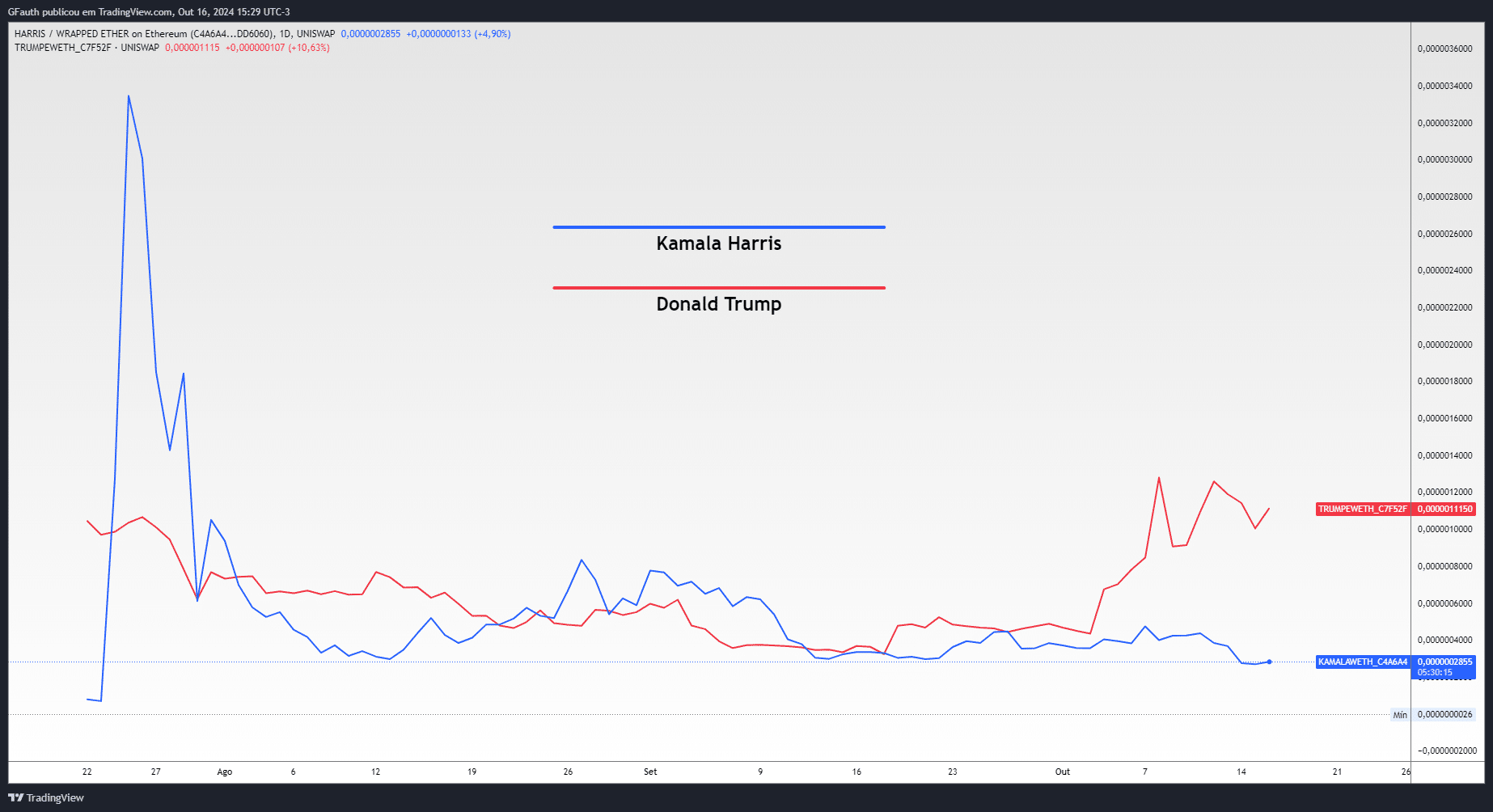

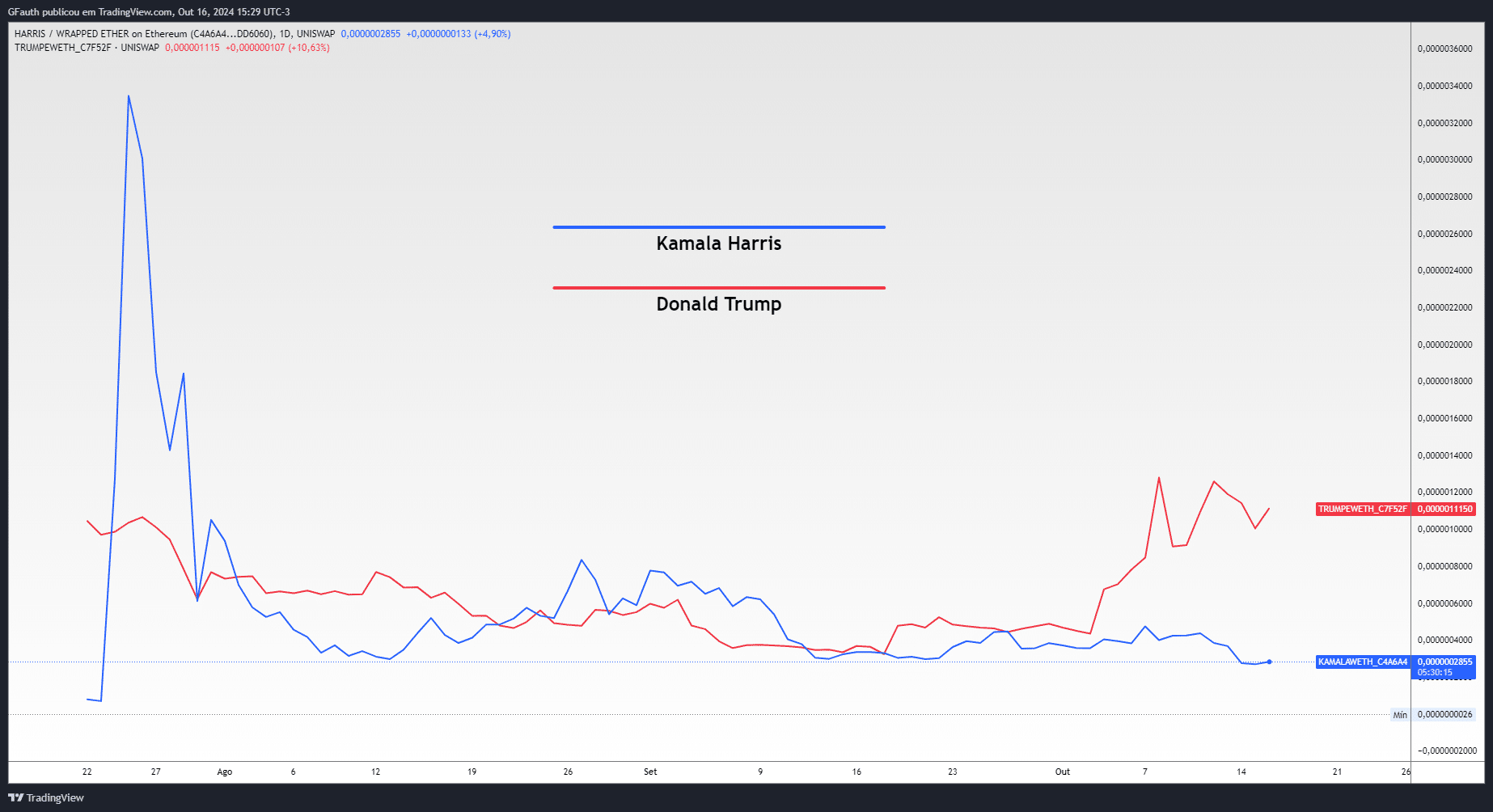

The price of assets like HARRISWETH and TRUMPWETH (a combination of Kamala Harris and Wrapped Ether or Trump and Wrapped Ether) moves based on several factors common in the decentralized finance (DeFi) and cryptocurrency market.

The law that regulates all markets, whether centralized or decentralized, is supply and demand, and this asset is no different. The price is influenced by the availability of liquidity in pools like Uniswap. When there is little liquidity or large buy/sell orders, the price can vary drastically due to limited supply. But there are other factors that, in this particular case, create demand for the asset.

Market sentiment is perhaps the strongest here. Speculative assets see rapid price changes based on market emotions such as fear and greed. For an asset like this, which contains the name of a political figure (Donald Trump), any related news or public perception could affect demand. This is part of the meme culture in the cryptocurrency space.

Tokens and elections in the US

Importantly, the performance of WETH as a single asset also influences the price of that asset. After all, it is a pair of traded tokens, if the Ethereum chart suffers some influence and loses strength, this directly impacts WETH prices and can naturally increase the value of the Harris or Trump pairs.

In the short term, this may just be a joke. But this is a real asset and reflects real business opportunities, and can serve as protection for market participants seeking to protect themselves from a specific government, or even reward those who wish to speculate for or against a specific candidate. Tokens tend to appreciate in value depending on the outcome of the election, with the opposite token being able to “turn to dust”, losing its value completely.

Like any investment, it is important to make decisions based on fundamentals, looking for the risk premium in that operation — if any. With an agnostic look. Working out of fanaticism is not the best of paths.

There’s a good saying for this: “friends are friends, business aside”.