Tiago Reis decides to buy Bitcoin and bet against MicroStrategy

After years of criticizing Bitcoin (BTC), Tiago Reis, founder of Suno Research, decided to include cryptocurrency in his portfolio. According to a publication by Reis in X, the operation took place this Monday (25).

“I am a long-term investor. However, this is a market anomaly. So I decided to make this trade. I don't recommend it to anyone. This is risky,” explained Reis in his tweet.

However, the operation apparently does not just involve the purchase of BTC, but rather the sale of MicroStrategy shares. In other words, Reis decided to buy BTC and also bet against Michael Saylor's company, which already holds almost 400 thousand BTC in cash.

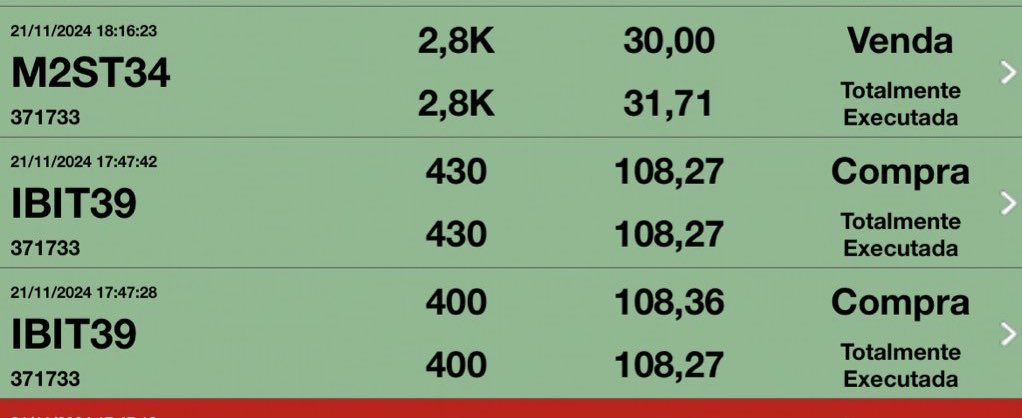

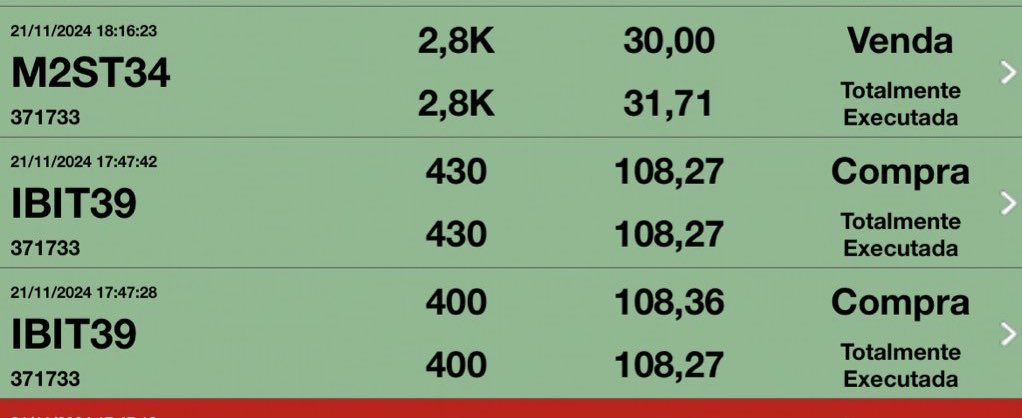

To expose himself to Bitcoin, Reis acquired 1,660 shares of IBIT39, BDR of BlackRock's Bitcoin ETF (IBIT) listed on B3. Then, Reis opened a sale operation of 5,600 MicroStrategy BDRs (M2ST34). In terms of values, Reis invested R$179,754.20 in the purchase of BTC via ETFs and R$172,788 in the sale of MicroStrategy

Bitcoin buys, MicroStrategy sells

It all started last Thursday (21), when Reis published a tweet about Bitcoin and MicroStrategy. The message was published three days before Michael Saylor's company closed a purchase of 51,000 BTC, the largest made by the company to date.

In his message, Reis published his intention to buy BTC and, at the same time, “short” the company’s shares (MSTR). The term “shortear” comes from the English short and means shorting an asset.

“It makes you want to buy Bitcoin… And short $MSRT (sic)… Long and short. What is the thesis for not doing this? This MSRT basically only has Bitcoin as an asset and is worth 3-4x more than the Bitcoin inside,” tweeted Reis.

In the same tweet, Reis stated that the thesis was not about investing in Bitcoin in the long term, but rather about arbitrage. He planned to bet on the appreciation of BTC (which is in an uptrend) and bet against MicroStrategy. Four days later, the analyst confirmed that he carried out the operation.

In another comment, Reis clarified that he placed a stop on the operation to limit his losses and that he has a target price on both assets. CriptoFácil contacted the analyst and asked about his position, but has not received a response so far. This article will be updated in case of return.

Holding Award at MicroStrategy

According to Reis, MicroStrategy is acting as a holding company, which is a company that invests in other companies. However, Michael Saylor's company became a BTC holding company, which began to store increasingly larger piles of the digital asset.

“They basically took an asset and put it inside an envelope. And, magically, this envelope is worth three times the value of the asset”, he explained.

In fact, the company is worth about 2.2 times its total BTC holdings. According to Nasdaq, MicroStrategy's market value is US$83.5 billion, while the company has the equivalent of US$37 billion in BTC. This value already includes the purchase of US$5.4 billion made this Monday, which added another 55,500 BTC to the cash balance.

Therefore, what Tiago Reis did was buy the underlying asset (BTC) and sell the “envelope” (M2ST34). “I placed a stop to limit my losses,” he explained.

Two year milestone

The founder of Suno Research has been a critic of Bitcoin since 2018 and has always stated that cryptocurrency was not an investment. His justification was similar to that of other investors: BTC does not generate income, something that the founder of Suno Research considers vital in his investment philosophy.

Interestingly, exactly two years and four days ago, on February 21, 2022, Reis even stated that “Bitcoin is over“, in response to another financial educator’s tweet. At the time, Charles Mendlowicz, known as the Sincere Economist, stood out BTC's drop to $15,997, the bottom of the last bull cycle.

Since Reis decreed this “death” of Bitcoin, the price of the cryptocurrency has recovered and surpassed its historical highs again in 2024. Counting from that November 21, 2022 until the closing of this article, the price of the cryptocurrency records accumulated gains of 505%.

Despite his criticism of Bitcoin, this is the first time that Tiago Reis has carried out any public financial operation regarding the digital asset.