Mango DAO refuses $700,000 settlement with SEC

Mango DAO, an organization that is part of the Mango Markets decentralized finance protocol, has rejected a settlement with the United States Securities and Exchange Commission (SEC). Under the proposal, Mango DAO would pay $700,000 for allegedly selling unregistered MNGO tokens.

As it is a DAO, Mango submitted the proposal for a vote among token holders. More than 27 million votes approved the agreement, but the number was insufficient to approve the negotiation.

Recently, the Crypto.com exchange received a Wells Notice for alleged trading in tokens classified as securities. This warning usually precedes a possible fine or suspension of activities.

Mango DAO rejects proposal to pay US SEC as part of settlement

According to data from the Realms platform, the deal involved not only the DAO, but also Mango Labs and the Blockworks Foundation. The two institutions agreed to pay this amount and destroy the MNGO tokens.

The problem is that the DAO representative needed to release the funds currently held in escrow to the SEC. The DAO contains around US$669,000, enough to pay off the fine. To do this, users needed to vote and approve the release, as it was Mango DAO's treasure.

The proposal failed, even though it received 27.2 million votes in favor, as it needed 52.2 million more votes. As a result, the DAO will not pay the fine.

Interestingly, smart contract developer Henry revealed on X that the proposal had 100 million votes in favor. However, voters withdrew 80 million of them 5 hours before the voting period closed.

Resistance against the SEC

This turnaround at Mango DAO comes amid Crypto.com's decision to sue the SEC for receiving the Wells Notice. As CriptoFácil reported, the exchange accused the SEC of going further and causing excesses with its jurisdiction.

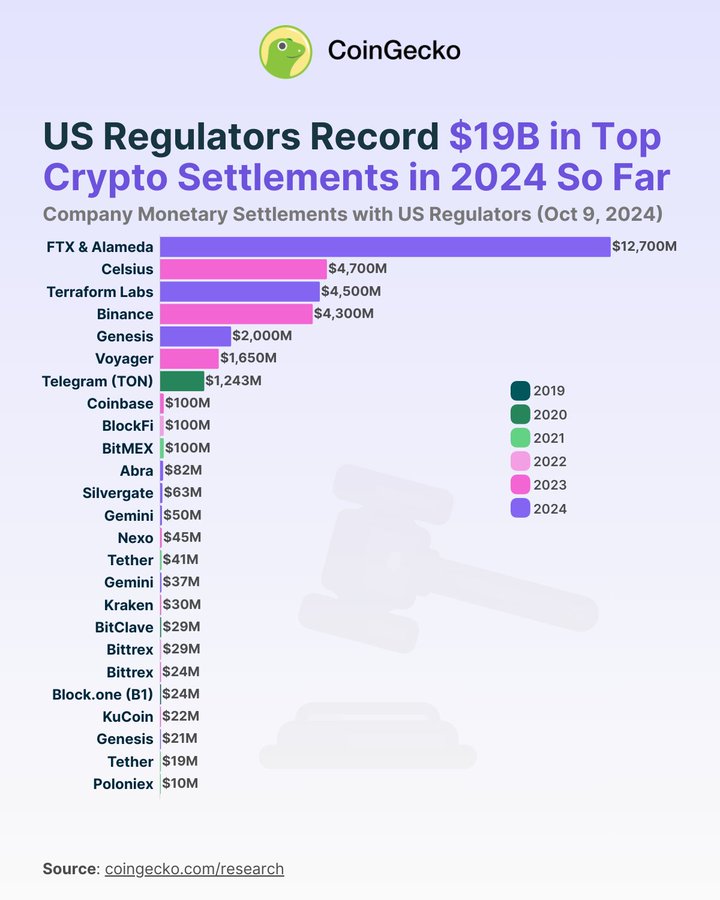

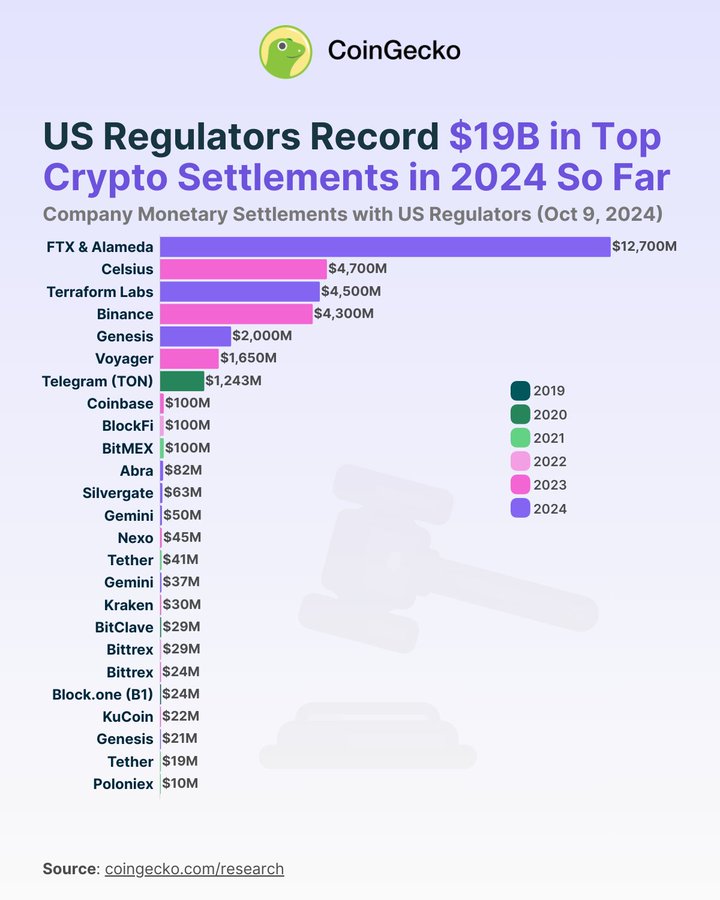

US regulators, including the US SEC, have reached several settlements with cryptocurrency companies thanks to these regulators' enforcement actions. A report from CoinGecko showed that cryptocurrency companies have reached $32 billion in settlements with these US regulators.

The biggest is the $12.7 billion deal made by FTX and Alameda with the Commodity Futures Trading Commission (CFTC). These companies, which declared bankruptcy, agreed to refund this amount to customers and fraud victims.

Meanwhile, the second-largest cryptocurrency settlement is lending platform Celsius' $4.7 billion fine, followed by the $4.3 billion settlement Terraform Labs reached with the SEC earlier this year. According to CoinGecko, US regulators have recorded $19 billion in core cryptocurrency deals this year.

- Biggest deals closed in the USA. Source: CoinGecko.