Ethereum: analyst predicts correction and drop to $1,550

The price of Ethereum (ETH) went against Bitcoin (BTC) and ended October with a drop of 3.4%. In addition to being the first low for the month since 2018, ETH also recorded losses of 4.1% this Friday (01), continuing its downward trend.

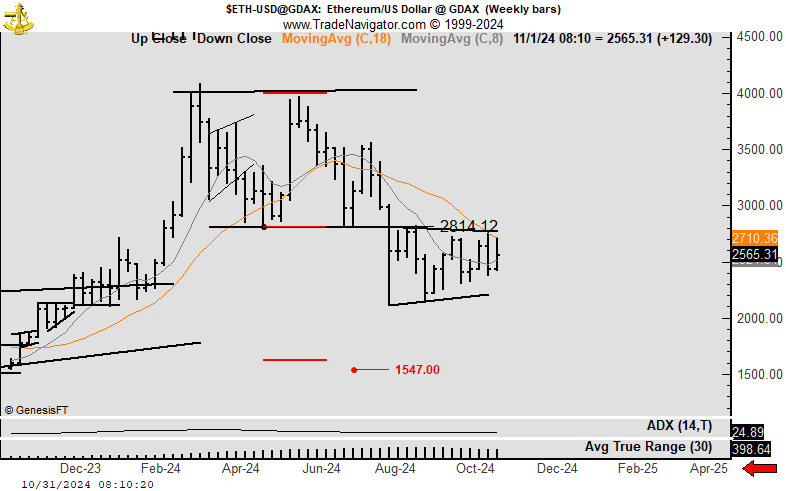

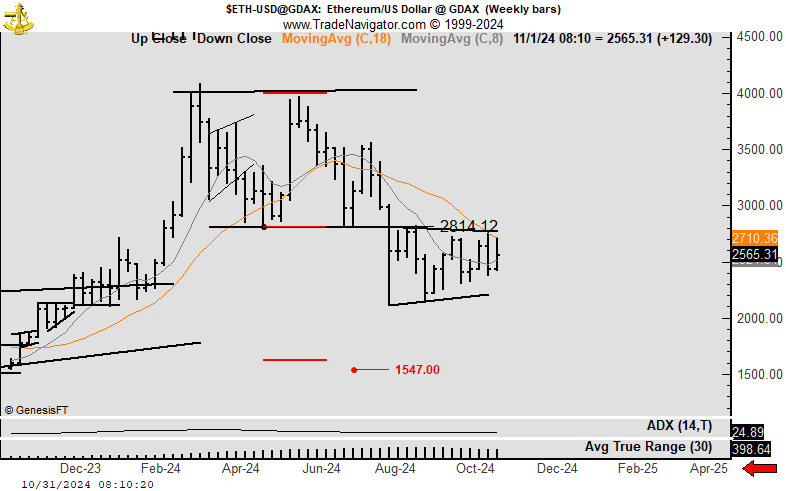

This correction showed ETH's difficulty in sustaining the $2,600 resistance for a long time and turning it into support. Given this scenario, veteran trader Peter Brandt already predicts a drop in ETH to US$1,550, which would be a correction of almost 20%.

Ethereum Price Could Fall to $1,550

In his analysis, Brandt noted two factors that confirm his assessment. The first is ETH's loss of strength in the $2,600 region, while the second is the absence of a buy signal, which consolidates the pessimistic graphic structure.

According to Brandt, ETH still has an unmet bottom target of $1,551, reinforcing a cautious outlook for the altcoin. In the analyst's view, ETH will not have the strength to seek new highs until it reaches this bottom.

The price of ETH has been forming lower tops and bottoms, which characterizes a bearish channel. For another analyst, Michael van de Poppe, if ETH continues its current downward momentum, the asset could see an additional decline of 10% to 20%.

On the other hand, van de Poppoe also believes that market conditions are approaching a potential reversal, both for US Treasury yields and for ETH itself. He highlighted that this Friday's US unemployment data will be crucial, influencing cryptocurrencies as a whole.

ETH close to the demand zone

Another popular analyst who goes by the pseudonym Mammon highlighted that the price of Ethereum is approaching a critical demand zone. This zone is characterized by the buying force's attempt to create a higher bearish formation, that is, with higher tops and bottoms.

Mammon warned that a weekly close below approximately $2,460 could signal risk given the accumulation of liquidity below the average level. On the other hand, ETH could successfully form a higher low within this support zone and retest the high volume area (VAH).

In this scenario, the trader sees a strong potential for a breakout. Recovering this level could set the stage for a significant price rally, according to their analysis.

Additionally, inflows into Ethereum spot ETFs are increasing again, with Ether spot ETFs recording positive net inflows over the past three days. On Thursday (31), the BlackRock ETF (ETHA) received US$50 million in investments, according to data from Farside Investors.