Company listed on Nasdaq makes purchase of US$ 1 million in Bitcoin

Thumzup Media Corporation, a Nasdaq-listed marketing and social media company, was the latest company to add Bitcoin (BTC) to its balance sheet. The company's board approved the $1 million Bitcoin purchase, according to an official statement.

The company's Board of Directors gave the green light to the decision, aiming to reinforce Thumzup's cash reserves. Like MicroStrategy and other companies, the decision aims to diversify cash through an inflation protection asset.

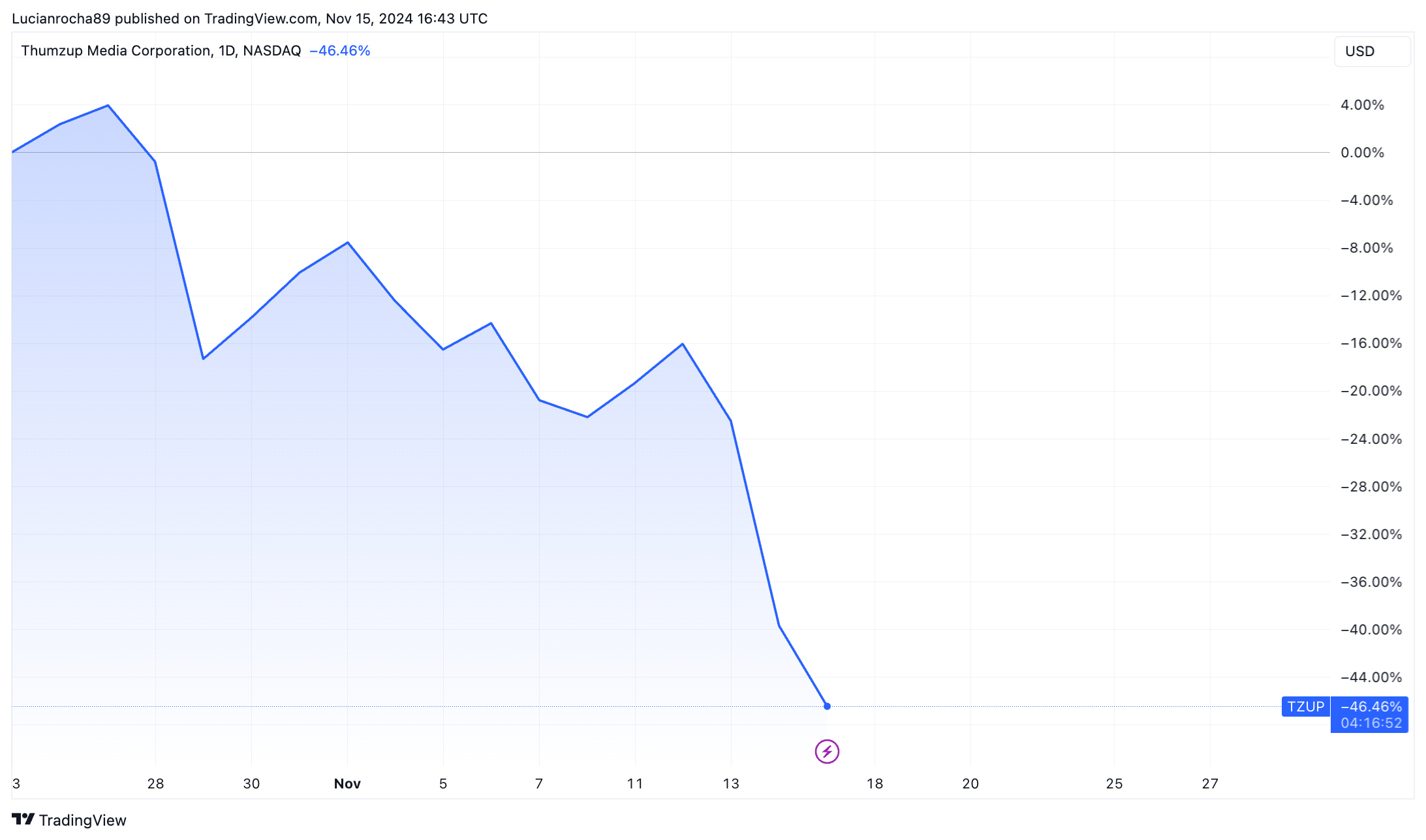

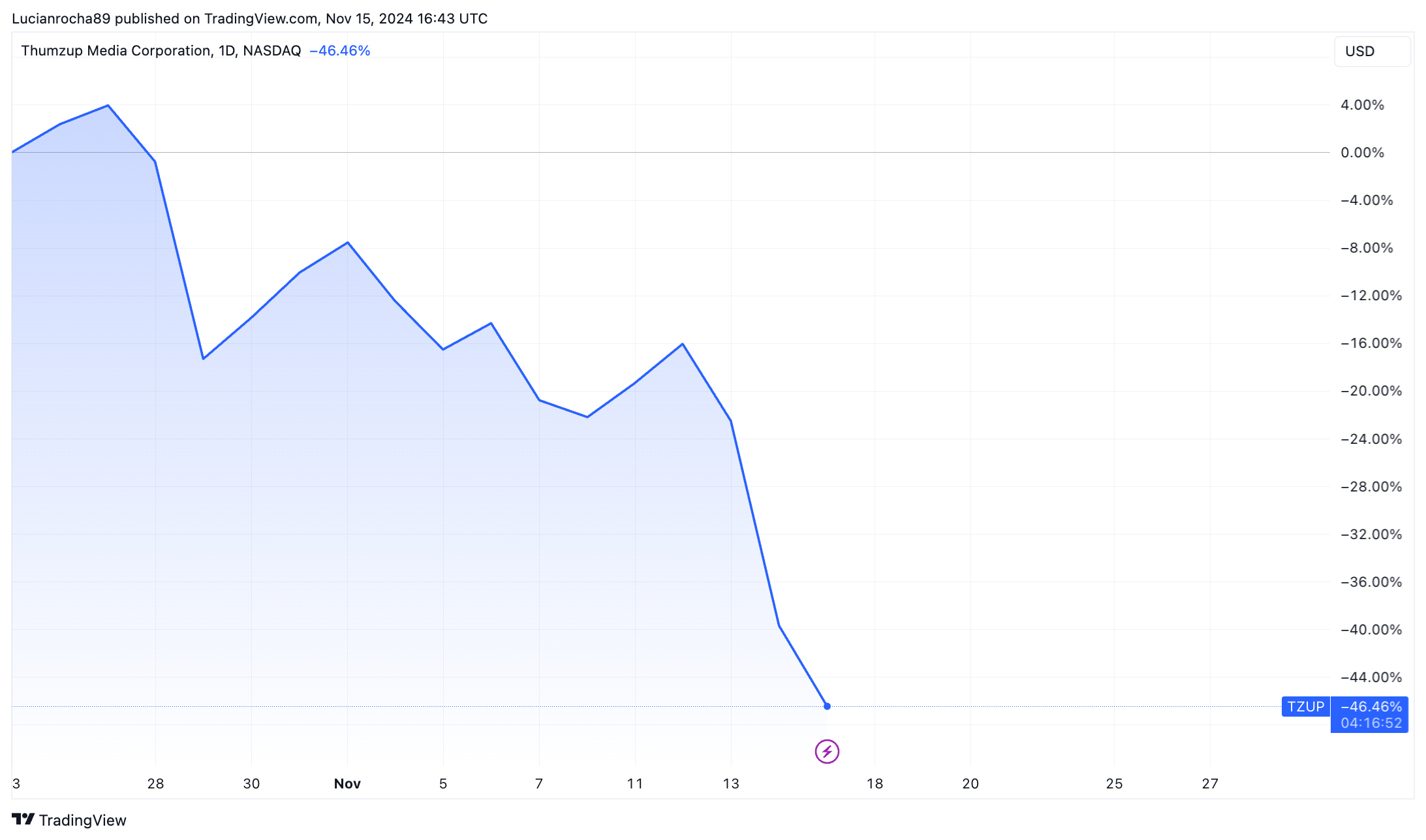

However, the decision did not increase the company's share price (TZUP), which recorded a drop of 11.23% in trading this Friday (15). The company's shares are priced at US$3.40, according to data from TradingView.

Council approves BTC acquisition

Thumzup, whose TZUP, confirmed its decision to invest in Bitcoin this Friday. This measure is aligned with the company's goal of improving its financial management.

In this sense, Thumzup seeks to leverage the qualities of BTC, such as its limited supply and resistance to inflation. Robert Steele, CEO of Thumzup Media Corporation, explained the rationale behind the change:

“As demand for BTC increases and it gains recognition as a leading asset class, we believe it will serve as a robust reserve asset for our treasury,” he stated.

Steele further highlighted the influence of recent developments, such as the introduction of ETFs and growing institutional interest, as factors increasing the reliability of Bitcoin as a financial asset.

At the time of completing this text, the price of Bitcoin registered a slight increase of 0.4% and its price is worth US$89,108.

Bitcoin attributes gain strength

BTC's unique attributes, including its limited supply of 21 million units, have made it an attractive choice for corporations looking to manage their reserves. This movement began in 2020 with MicroStrategy and more and more companies started to adopt it.

By integrating BTC into its financial strategy, Thumzup aims to protect its assets from the effects of inflation and economic uncertainty. In this way, the company joins several others that have already hoarded BTC.

The approval of the purchase of Bitcoin comes at a time when large financial institutions such as BlackRock and Fidelity are also investing in the cryptocurrency.

The adoption of Thumzup reflects a growing trend among companies to diversify their reserves with digital assets, especially with potential regulatory clarity with pro-crypto Donald Trump's victory in the US election.

At the same time, Senator Cynthia Lummis of Wyoming proposed a plan to use part of the US Federal Reserve's (Fed) gold reserves to finance the acquisition of one million BTC. This proposal aims to strengthen the United States' strategic reserve in other assets, including cryptocurrency.