Chainlink launches platform for private transactions and LINK rises

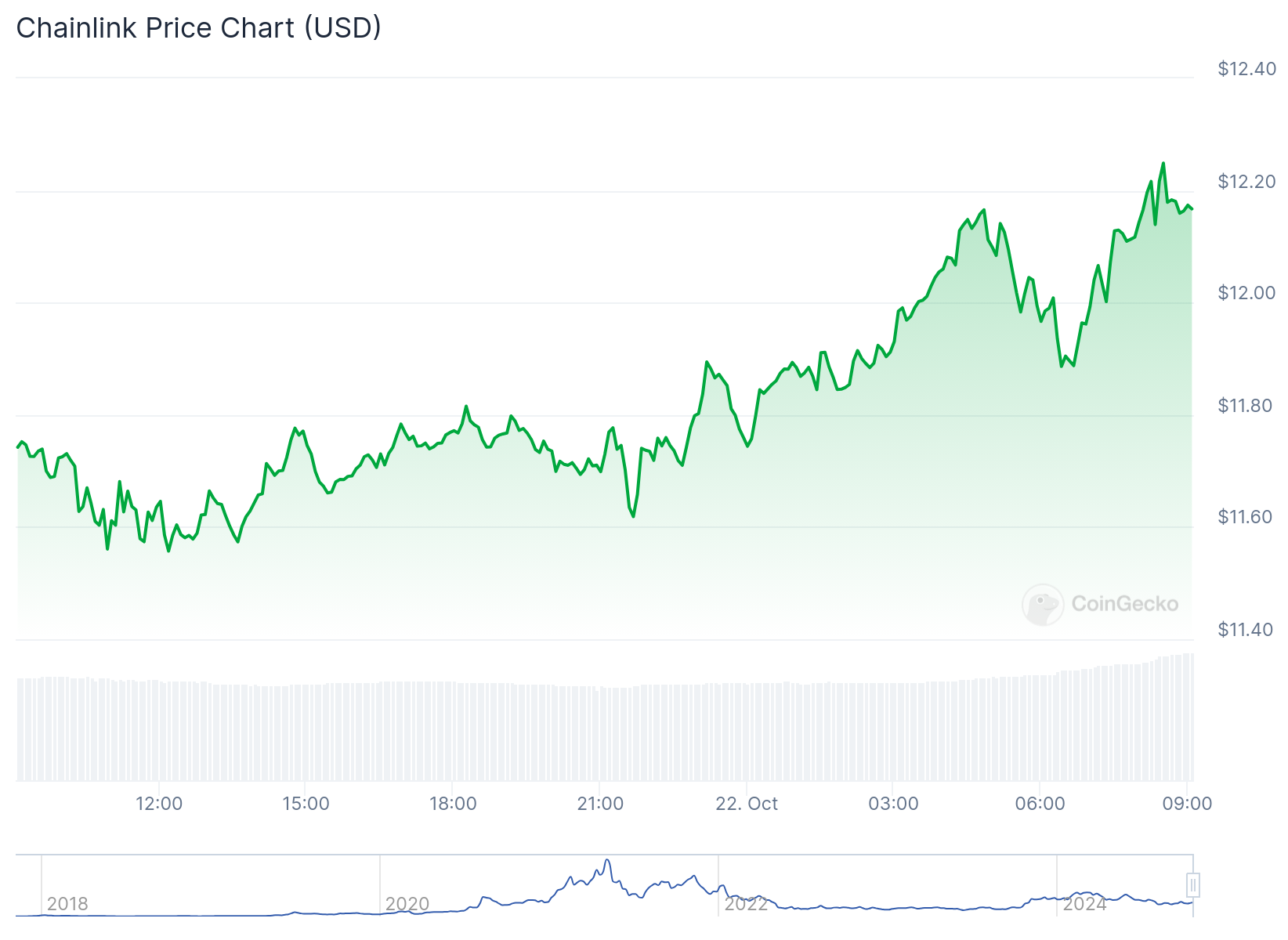

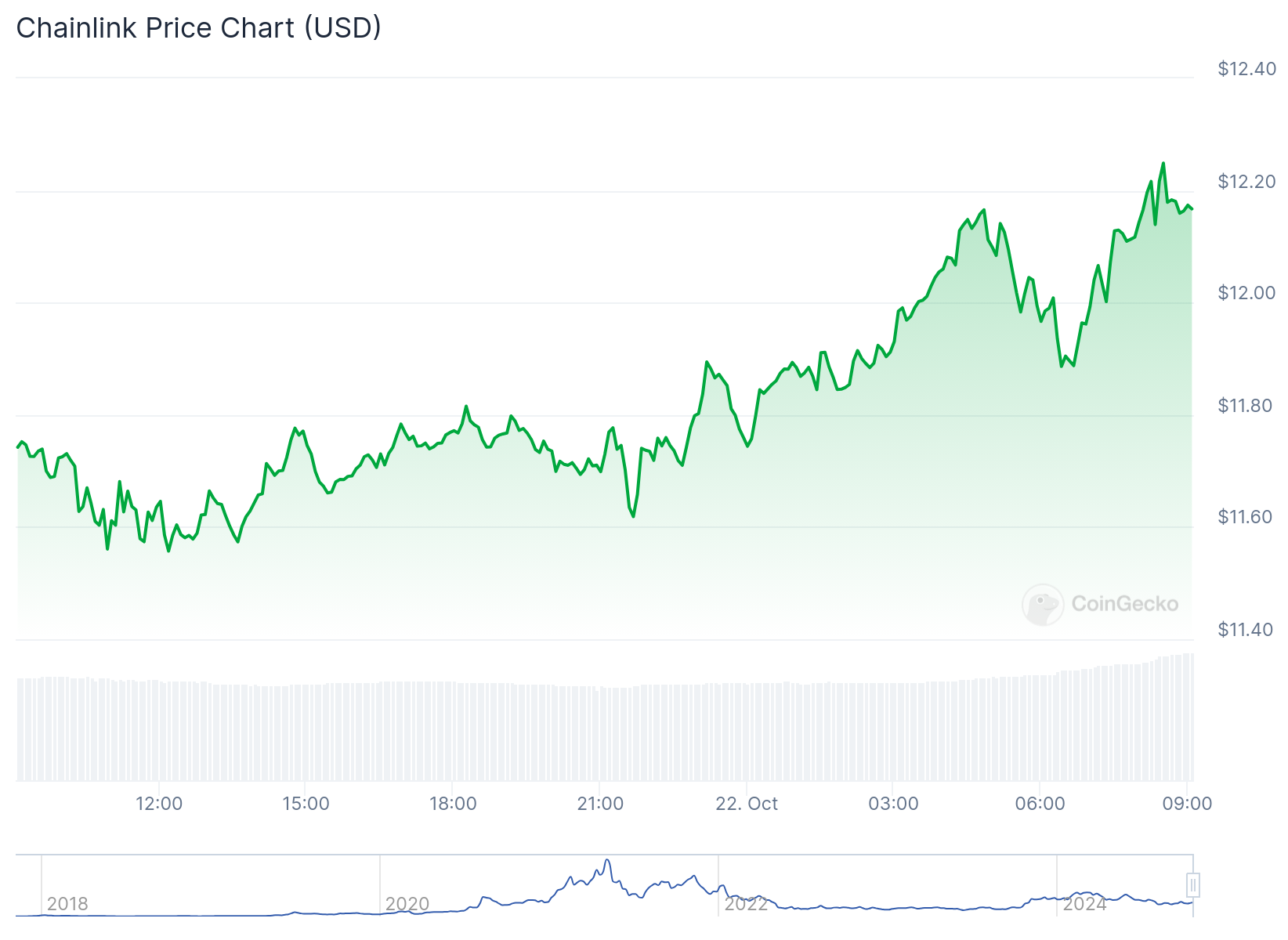

Chainlink's LINK token recorded its highest value since the end of September, driven by the launch of a new technology aimed at financial institutions. According to data from CoinGecko, the price of LINK reached a peak of US$12.25 before retreating slightly to US$12.17 this Tuesday (22).

This movement represents a continuation of the uptrend, with the token accumulating growth of around 10% in the last two weeks and almost 4% in the last 24 hours.

LINK is currently among the top 20 digital assets, with a market value of approximately US$7.5 billion.

Private transactions with Chainlink CCIP

On October 22, Chainlink launched the Cross-Chain Interoperability Protocol (CCIP) Private Transactions. It is a solution that allows financial institutions to connect their private blockchains with other networks.

According to the announcement, the new platform aims to solve the challenge of privacy in cross-blockchain interactions, which has been an obstacle to the adoption of blockchain solutions by regulatory-compliant financial institutions.

Chainlink announced that the Australia and New Zealand Banking Group (ANZ) was one of the first institutions to adopt the new platform. CCIP will enable the settlement of real-world tokenized assets across different chains in line with Project Guardian, led by the Monetary Authority of Singapore (MAS).

Chainlink’s Blockchain Privacy Manager will be the core component of this new technology. The solution allows private blockchains to use CCIP to connect with other networks, whether public or private, as well as external data sources and traditional financial systems, while maintaining transaction privacy.

Institutions that use the Privacy Manager will be able to define specific privacy parameters for each transaction. Furthermore, they can hide sensitive information, such as personal data, token values and counterparties involved. On the other hand, it may keep other on-chain information revealed.

Nigel Dobson, ANZ Banking Leader, said the new platform addresses long-standing challenges related to privacy in institutional blockchain transactions. As highlighted, this advance can accelerate the adoption of blockchain by financial institutions.

New solutions for blockchain privacy

Sergey Nazarov, co-founder of Chainlink, commented that, to date, the blockchain industry has not offered the level of privacy necessary for these institutional transactions to thrive, which has limited the sector's growth.

According to Nazarov, with the possibility of carrying out private transactions between different chains, a significant increase in institutional adoption of blockchains, CCIP and the Chainlink standard in general is expected.

In addition to the Privacy Manager, Chainlink has introduced a Sandbox for DECO, a privacy-preserving data verification system. DECO uses zero-knowledge proofs (ZKPs) and existing web infrastructure to ensure the privacy of participants in blockchain transactions. Although DECO is still in the testing phase, Chainlink plans to make it publicly accessible soon.